Product Description

Features

- Remote Tax Rules in the cloud

- Define Tax Rules which apply or deduct origin based- or destination based value added tax or sales tax dynamically

- Marketplace Operators can define their own Marketplace Tax Rules

- Single Shop Owners can define their own Tax Rules

- Even Vendors of Marketplaces can define their own Tax Rules

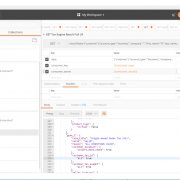

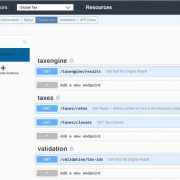

- Process Remote Tax Rules in the cloud by the Dynamic Tax Rule – Engine in the Cloud and access the results locally

- Remote Tax Rates in the cloud

- Access to International Tax Rates *)

- Marketplace Operators can define their own Marketplace Tax Rates

- Single Shop Owners can define their own Tax Rates

- Even Vendors of Marketplaces can define their own Tax Rates

- Optionally Tax Rates from Third Party Tax Rate Provider can be used

- Access Remote Tax Rates remotely and locally

- Supports Multi Vendor Tax Rules

- Supports individual Tax Rules for specific sellers or a group of vendors

- Applicable for all regions in the world

- Supports common business processes in the

- EU like

- intra-community-supply

- reverse charge on virtual products

- small businesses

- export

- US like

- origin based states,

- destination based states,

- nexuses in origin- and destination based states

- EU like

- Global Tax as a Service is built on Multi Tenancy Cloud Server for WordPress

*) In some regions of the world we rely on partners, which provide the rates. We include these rates in our solutions for free, as long as they are free to us.

*) Currently we provide World Wide Standard Tax Rates (US Sales Tax, VAT, GST, SST, TOT,COT), (Tangible Personal Property in the US through Avalara) and Reduced EU Rates

SAP S/4HANA Integration with External Tax Calculation Engines

We support the official SAP Integration Flow “SAP S/4HANA Integration with External Tax Calculation Engines”

Fully integrates Solutions

Currently fully integrated solutions into the following platforms are available. These solutions are not included and can be purchased separately.

- Global Tax for WooCommerce (eCommerce Shop)

- Global Tax for Dokan (eCommerce Marketplace)

- Global Tax for WC Vendors (eCommerce Marketplace)

- Global Tax for Product Vendors (eCommerce Marketplace)

- Global Tax for WC Marketplace (eCommerce Marketplace)

Within these currently available solutions all provided remote micro services are connected. However these solutions are thick clients which can run standalone even without use of these remote services.

If your favorite shop or marketplace software is not listed yet you can either develop it yourself or ask us to develop it. .

Our innovative technology allows us to use multiple tax rate providers for the same location simultaneously (for fallback scenarios), therefore we encourage customers as well as tax rate providers all over the world to integrate with us.

Licence

- Single Site Licence

- Usage of this cloud service for

- one single shop

- a marketplace for up to 5 vendors

- a site revenue up to €1000/month

Liability

THE SOFTWARE AND SERVICES ARE PROVIDED “AS IS”, WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM, OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

THE SOFTWARE AND THE PROVIDED TEMPLATES AND TAX RULE SAMPLES CANNOT REPLACE LEGAL OR TAX ADVICE TAILORED TO YOUR INDIVIDUAL NEEDS

Mark – :

The only cloud based tax solution we found which could deal with multi vendor carts!!!