Product Description

Features

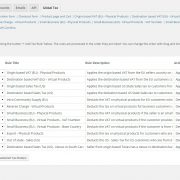

- Dynamic Tax Rule – Engine, which

- deducts or applies the relevant origin based- or destination based tax based on business processes.

- calculates Value Added Tax (VAT), Sales Tax and/or Goods and Services Tax (GST)

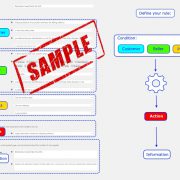

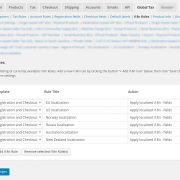

- Flexible Tax Rule – Configurator, which allows you to configure tax rules for your relevant business processes.

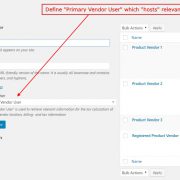

- Supports Multi Vendor Tax Rules (Multi Seller Tax Rules) for Product Vendors

- Supports individual Tax Rules for specific sellers or a group of sellers

- Tax Rule – Templates for

- the European Union

- the United States

- Australia

- India

- all other regions of the world (Generic template)

- Predefined sample tax rules for

- EU

- intra-community-supply

- reverse charge on virtual products

- small businesses

- export

- US

- origin based states,

- destination based states,

- nexuses in origin- and destination based states

- EU

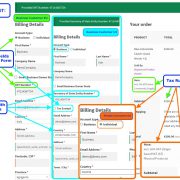

- Automatic EU-VAT-number validation by the VAT Information Exchange System (VIES) (requires “Global Tax as a Service”)

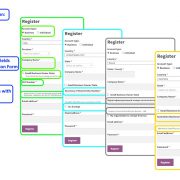

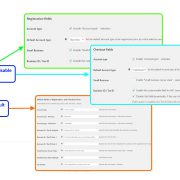

- Additional business fields in the Registration-, Checkout-, Order- My-Account- and Admin User Forms.

- Account type

- Company name

- Small Business owner state

- VAT-number / Secretary of State Entity Number / ABN / GSTIN / Tax ID (or any other ID)

- Tax exempt

- Additional customer information on product page and cart

- i18n-Rules support easy customization of fields and settings specific to customer- and/or vendor location

- Display prices inclusive or exclusive of tax by customer location

- Display tax rates prefix specific to customer location requirements

- All fields are fully customizable, localize all labels by location from the backend

- any kind of tax-id or certificate of registration, etc.. can be requested from customers.

- Minimum Taxable Address Requirements can be defined per vendor and customer locations, which controls whether or not taxes are calculated and displayed to customers

- Permit or deny vendor roles with Account Rules

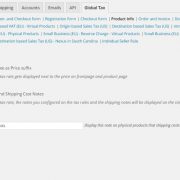

- Display options on frontpage, product page, cart and checkout

- Price Tax Rate Suffix

- Applied Tax Rule

- Tax Rate Breakdown

- Tax Rate Provider

- Taxable Address

- Registration log

- Uses Geolocation to show your customers the correct price according to their destination even before they enter their address at checkout

- Supports WooCommerce Subscriptions

- WC 5.x Ready

Optional Features (sold separately):

- Access to Global Tax Rates (requires “Global Tax as a Service”)

- Access to VAT Information Exchange System (VIES) (requires “Global Tax as a Service”)

Optional Add-Ons (sold separately)

- Global Tax Vendor Frontend for Product Vendors

- Global Tax Rules Import / Export

- Global Tax Checkout Limits

- Global Tax Avalara Connector for Product Vendors

Optional Cloud Services (sold separately):

- Global Tax as a Service

- Access to Global Tax Rates

- Access to VAT Information Exchange System (VIES)

- Remote Tax Calculation

- and More…

Requirements

- Global Tax Business Subscription – Product Vendors Edition

- WooCommerce (version 2.4 or greater, may work with lower versions, too, but is not tested)

- Tax Rates need to be entered manually in WooCommerce or “Global Tax as a Service” needs to be purchased (not included)

- WooCommerce “Tax Options” need to be set to “Prices entered exclusive of tax”

- WooCommerce “Zero Rate” – Tax Class needs to be available

- WooCommerce Product Vendors – Plugin (version 2.0.19, may work with other versions, too, but is not tested)

Further Links:

- Global Tax Solutions (@ blueantoinette.com)

- GT4M – Global Tax for Marketplaces and More (@ gt4m.com)

Liability

THE SOFTWARE IS PROVIDED “AS IS”, WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM, OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

THE SOFTWARE AND THE PROVIDED TEMPLATES AND TAX RULE SAMPLES CANNOT REPLACE LEGAL OR TAX ADVICE TAILORED TO YOUR INDIVIDUAL NEEDS

Reviews

There are no reviews yet.